FENWICK ISLAND, Del. - While some vacationers look for a quieter alternative to Ocean City, some locals say Fenwick Island is becoming a hot spot for family beach trips — but a proposed tax adjustment could soon impact what visitors pay to stay there.

Bob Watson, a Fenwick Island resident who moved to town more than three years ago, says he’s noticed more people choosing Fenwick over nearby resort towns. “Usually a lot of families are just looking for a quieter place,” Watson said. “They tend to gravitate toward Fenwick Island — something a little less commercial.”

But those choosing short-term rentals, such as Airbnb or Vrbo, may see higher bills in the near future.

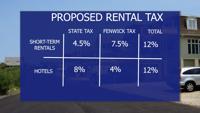

At a recent Budget and Finance Committee meeting, town officials discussed adjusting the rental and hotel tax rates in response to a new 4.5% state tax on residential communities in Delaware that took effect this year.

Currently, short-term rentals in Fenwick Island pay a combined 12.5% in state and local taxes, while hotels are taxed at a lower 11.5% rate.

Currently, short-term rentals in Fenwick Island pay a combined 12.5% in state and local taxes, while hotels are taxed at a lower 11.5% rate.

To even the scales, the committee proposed reducing the town’s residential rental tax from 8% to 7.5% and increasing the hotel tax from 7% to 7.5%, bringing both categories to an equal 12% total.

“The town, which has always charged an 8% rental tax rate for residential properties — we just proposed in our committee to reduce that to only 7.5%,” said Town Treasurer Bill Rymer.

To even the scales, the committee proposed reducing the town’s residential rental tax.

Watson expressed concern that any increase in lodging costs could deter families from vacationing in Fenwick. “More people are going to be interested in finding a good deal for their vacations,” he said. “And I think that an increase of this kind of magnitude is probably going to make people consider other locations as well.”

The Fenwick Island Town Council is expected to review the proposed changes at its June 27 meeting. If approved, the new tax rates would take effect in 2026.